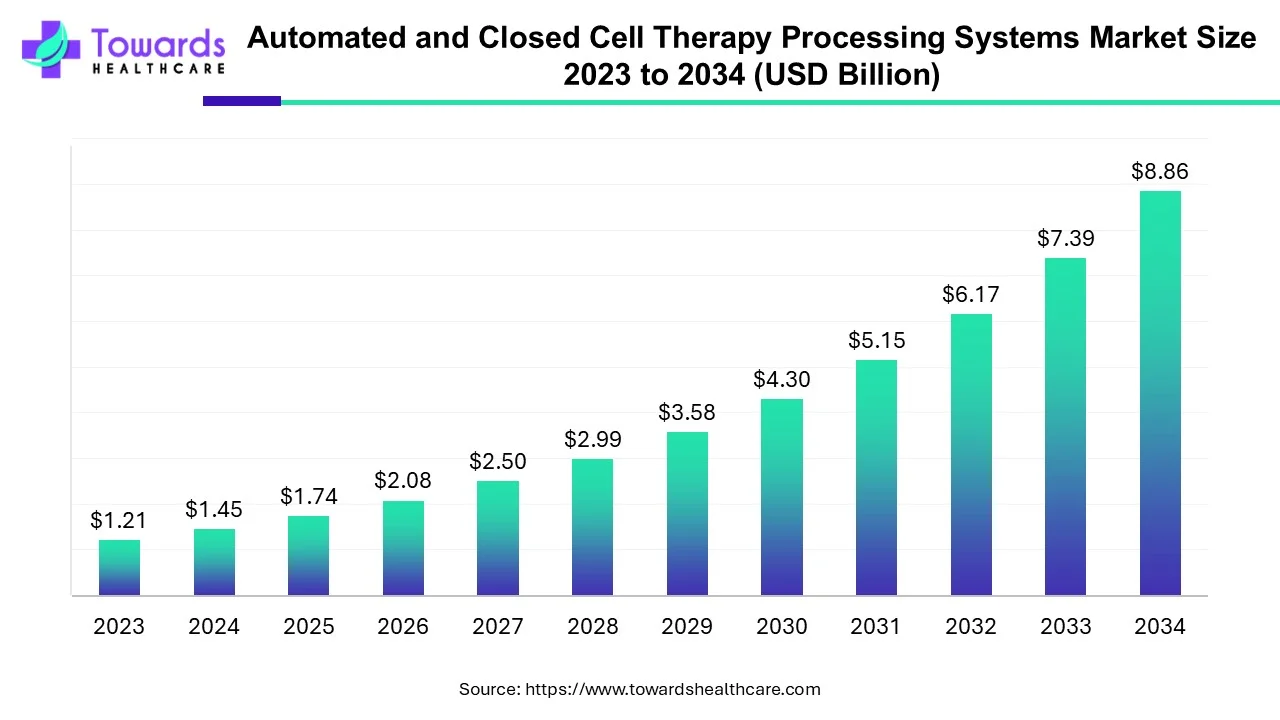

Automated and Closed Cell Therapy Processing Systems Market Size to Grow at 19.84% CAGR

The automated and closed cell therapy processing systems market is valued at USD 1.74 billion in 2025 and is projected to reach USD 8.86 billion by 2034, at a CAGR of 19.84%.

Ottawa, Sept. 18, 2025 (GLOBE NEWSWIRE) -- According to a study by Towards Healthcare, a sister company of Precedence Research, the global automated and closed cell therapy processing systems market was valued at USD 1.45 billion in 2024 and is expected to reach USD 8.86 billion by 2034, growing at a CAGR of 19.84%.

This market is rising due to rising global demand for personalized, safe, and scalable cell‐based therapies requiring automated, closed processing systems.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5402

Key Takeaways:

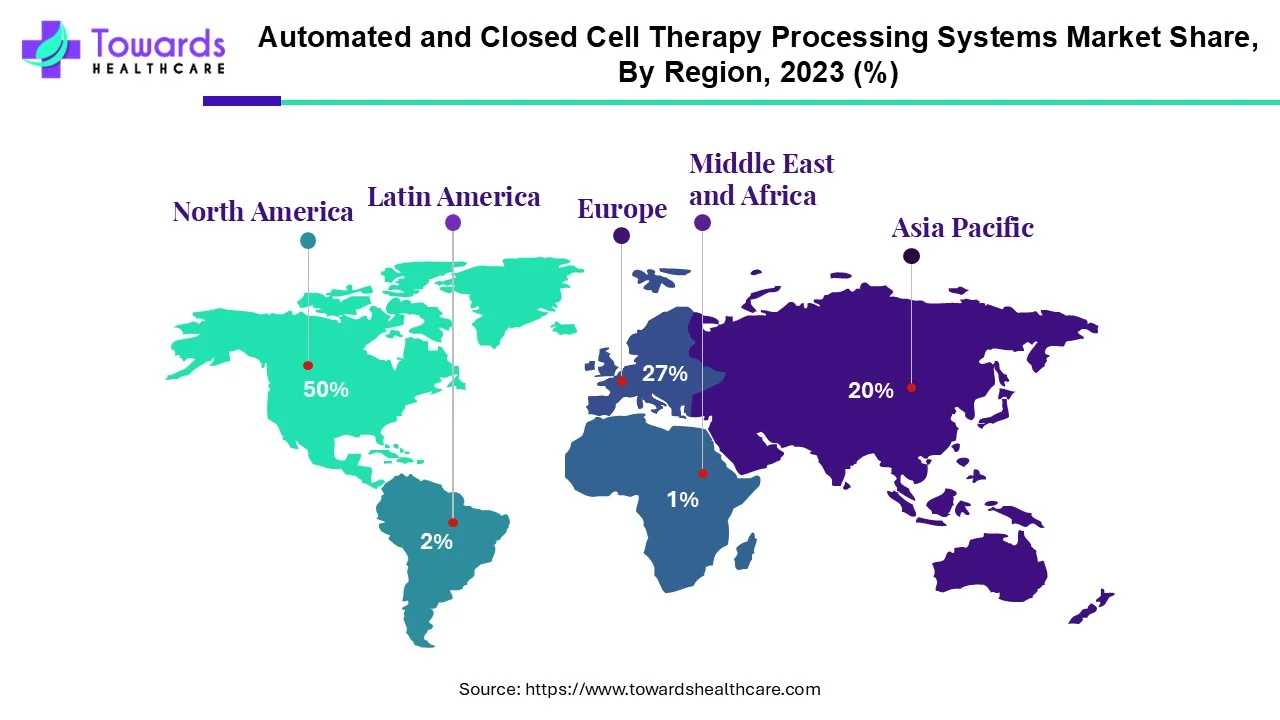

- By region, North America remains the dominant region holding 50% share in this market.

- The Asia-Pacific region is the fastest-growing segment.

- By workflow, the separation segment currently dominates the workflow category, representing the largest share of revenue.

- By workflow, the expansion segment is growing the fastest among workflows.

- By type, the non-stem cell therapy type segment dominates at present.

- By type, stem cell therapy is the fastest-growing type segment.

- By scale, the pre-commercial/R&D scale segment dominates currently.

- By scale, the commercial scale segment is the fastest growing.

Market Overview:

The global market for closed and automated cell therapy processing systems is experiencing healthy growth, reflecting the ongoing trend of increasing demand for safe, scalable, and standardized cell and gene therapies. The closed, automated cell therapy processing systems we refer to use automation to help automate flows that help increase reproducibility, decrease exposure to contamination, and conform to rigorous GMP requirements. The increasing global incidence of chronic and inherited diseases coupled with the growth in total R&D spending on regenerative medicine is accelerating the adoption of automated cell therapy systems.

Moreover, the favourable regulatory policies indicate a system of regulatory policies increasingly favouring closed systems for compliance to regulatory policies is fuelling market adoption. The adoption is increasing from pilot systems by biotechnology firms, contract development & manufacturing organizations (CDMOs), academic institutions, and hospitals are building up capacity to deliver personalized medicines. As the technology improves through experience, expectations are moving towards automation, modularity as well as the integration of quality controls and analytics approaches.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Major Growth Drivers:

- As personalized medicine and cell/gene therapies surge, especially in oncology, rare genetic disorders, and autoimmune diseases, there is increasing pressure for efficient, high‐quality manufacturing systems. Manual and open processes simply cannot meet the throughput, sterility, reproducibility, and scale required.

- New technology, automation robotics, AI/ML for process monitoring, real-time analytics, modular closed systems, single-use disposables, is reducing operational risk, and helping to reduce year after year costs.

- To deal with the regulatory demands and patient safety and efficacy concerns, governments and regulatory agencies are pushing for standards that require closed systems to protect against contamination and provide traceability, which drives adoption.

- Ramping R&D investment from public (government funding, grants) and private (VC, biotech, large pharma) is result in complex pipelines and heightening need for processing systems that can scale from bench to clinical to commercial.

- Complex diseases are being diagnosed at alarming rates, elderly populations are growing, and the public health burden globally is rising resulting in need for innovations in therapies increasing demand. This makes reliable automated cell therapy processing systems essential infrastructure in many health care markets both public and private.

Key Drifts:

Key changes and surging factors affecting the growth:

There is a trend towards companies developing multiple step (separation, expansion, washing, fill finish) modular, closed processing units as an integrated set or enclosed module. This reduces manual transfer, contamination risks and improves consistency. To reduce cleaning validation, cross contamination, and turn-around time, an increasing number of systems are utilizing single-use disposables for tubing, bags, fluid paths etc. The utilization of predictive analytics, process control via AI/ML, sensors to capture data on cell growth, viability, metabolites in a real time is becoming more commonplace.

These tools will ultimately provide better yields, less waste, and more reproducibility. There is a growing trend towards smaller footprint, mobile or modular systems which can be deployed at the point of relevant patient care, or at multiple locations, not just limited to centralized very large plants. Regulatory bodies are increasingly asking players to use closed systems for critical steps to keep sterility and maintain traceability which requires adoption or upgrades.

Significant Challenge:

Obstacles to Widespread Adoption:

High capital expenditure is one of the biggest barriers; it is often true that purchase, installation and validation can take place on a closed, automated system from a reputable vendor at all-or-most pharmaceutical quality levels, if the cost is not prohibitive. For smaller and even some larger biotech companies, academic labs or institutions in emerging markets, the cost is often too high and unfeasible given fixed budget limits.

A second big barrier is regulatory burden: increasingly complex regulatory bodies, and an absence of any global standards complicates this. Each regulatory jurisdiction may have different expectations, validity of the automated logic and the automated software, clean path sterility, record management issues, and so on can all take time, sap budgets and add risk.

Lack of standardised workflows or equipment/protocol interoperability can make technical transfers and scale-ups challenging. There is also lack of skilled labour to operate advanced systems (maintaining, calibrating, validating). Limitations in supply chain can limit production also if the demand is greater than the manufacturers can support.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Regional Analysis:

North America remains at the forefront of this market holding 50% share. The United States is pioneering institutional adoption of the technologies and solutions, with unparalleled regulatory clarity, considerable R&D investments, biotechnology and CDMO hub development, and the earliest commercial approvals for cell & gene therapies. North American based companies are often the first to commercialize, producing a sizeable share of revenue and installed systems in North America.

The Asia-Pacific region is the fastest growing segment. Countries such as China, Japan, South Korea, and India are ramping up investments into cell therapy infrastructure, government incentives/regulatory support for regenerative medicine, expansion of clinical trial activity, and growing healthcare expenditure. These catalysts, along with burgeoning domestic manufacturing and rising demand, are the driving force for high CAGR in the Asia-Pacific.

Segmental Insights:

By workflow:

The separation step category clearly leads the way, as it has the largest revenue share. This is because separation is critical to almost any cell therapy workflow as the first step and can be automated to improve purity and reduce contamination. The expansion step category is the fastest growing, therapies are moving from discovery/R&D to obtain CLINICAL and COMMERCIAL production at which point the demand for large-scale, reliable, and automated expansion systems is increasing.

By type:

The non-stem cell therapy type is currently the biggest segment. Non-stem cell therapies have generated more approvals and commercial viability, leading to an increased demand for processing systems meant for those types of therapies, which in turn includes gene modified T cells and immune cell therapies. The stem cell therapy type segment is growing at the fastest rate. The other factor driving this growth is that regenerative medicine is attracting a lot of interest, along with improved technology and new pathways being created to expedite regulatory approval.

By scale:

The pre-commercial/R&D scale segment is currently the dominate player. There are many early clinical trials and translational research projects using closed/automated systems for process development, validation, proof-of-concept and early GMP work. The commercial scale segment is the fastest growing. More therapies are advancing towards late-stage trials and approval where commercial production will begin.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Recent Developments:

- In April, 2024, Thermo Fisher Scientific launched an animal origin-free (AOF) formulation for cell therapy manufacturing; this innovation improves T-cell expansion, reduces risk associated with animal-derived reagents, and supports scalable production with greater safety and reproducibility.

Automated and Closed Cell Therapy Processing Systems Market Key Players

- Beckman Coulter

- Bristol Myers Squibb

- Cellares, Inc.

- Cellular Origins

- Charles River Laboratories

- Cytiva Life Sciences

- Danaher Corporation

- Fresenius Kabi

- Miltenyi Biotec

- Multiply Labs

- Sartorius AG

- Sigma Aldrich

- Thermo Fisher Scientific

- Terumo Corporation

Browse our Top Selling Insights:

The global biotechnology market is poised for significant growth, with its size forecasted to rise from USD 1,744.83 billion in 2025 to USD 5,036.46 billion by 2034, registering a CAGR of 12.5% during the forecast period. This expansion is driven by continuous innovation and advancements in biotechnology technologies.

The cell and gene therapy market is projected to surge from USD 21.82 billion in 2024 to USD 187.44 billion by 2034, achieving a remarkable CAGR of 24%. The growth is fueled by an increasing number of clinical trials and product approvals in the sector.

The home healthcare market is expected to grow from USD 226.92 billion in 2025 to USD 476.80 billion by 2034, at an annual growth rate of 8.6%, supported by rising demand for in-home patient care solutions.

The global pharmaceutical market is estimated at USD 1,573.20 billion in 2023 and is projected to reach USD 3,033.21 billion by 2034, expanding at a CAGR of 6.15% from 2024 to 2034, driven by innovation and rising healthcare needs.

The cold storage market is anticipated to increase from USD 172.98 billion in 2025 to USD 479.69 billion by 2034, growing at a CAGR of 12%, reflecting the rising demand for temperature-sensitive pharmaceutical and biotechnological products.

The clinical trials market is expected to expand from USD 54.39 billion in 2024 to USD 94.68 billion by 2034, at a CAGR of 5.7%, fueled by the rising number of clinical studies and global research initiatives.

The medical devices market is projected to grow from USD 586.2 billion in 2025 to USD 1,022.50 billion by 2034, with a CAGR of 6.34%, driven by technological advancements and favorable regulatory policies.

The electronic health records (EHR) market is forecasted to grow from USD 28.60 billion in 2024 to USD 43.66 billion by 2034, registering a CAGR of 4.32%, reflecting the increasing adoption of digital healthcare solutions.

The pharmaceutical CDMO (Contract Development and Manufacturing Organization) market is expected to rise from USD 146.05 billion in 2023 to USD 315.08 billion by 2034, expanding at a CAGR of 7.24%, driven by outsourcing trends and increasing demand for drug development services.

The digital health market is projected to grow from USD 335.51 billion in 2024 to USD 1,080.21 billion by 2034, achieving a CAGR of 13.1%, fueled by technological innovations and increasing demand for digital healthcare solutions.

Segments Covered in the Report

By Workflow

- Separation

- Expansion

- Apheresis

- Fill-Finish

- Cryopreservation

- Others

By Type

- Stem Cell Therapy

- Non-Stem Cell Therapy

By Scale

- Pre-Commercial/ R&D Scale

- Commercial Scale

By Region

- North America

- US

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/price/5402

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.